403b 2025 Limits. The combined employee and employer contribution limit is $66,000. This limit applies to all employees, regardless.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2025 is $23,000, up $500 from 2025. The 2025 403 (b) contribution limit is $22,500 for pretax and roth employee contributions.

403b Limits 2025 Cami Marnie, In some cases, this will allow you. Learn about the contribution limits for 403 (b) retirement plans in 2025.

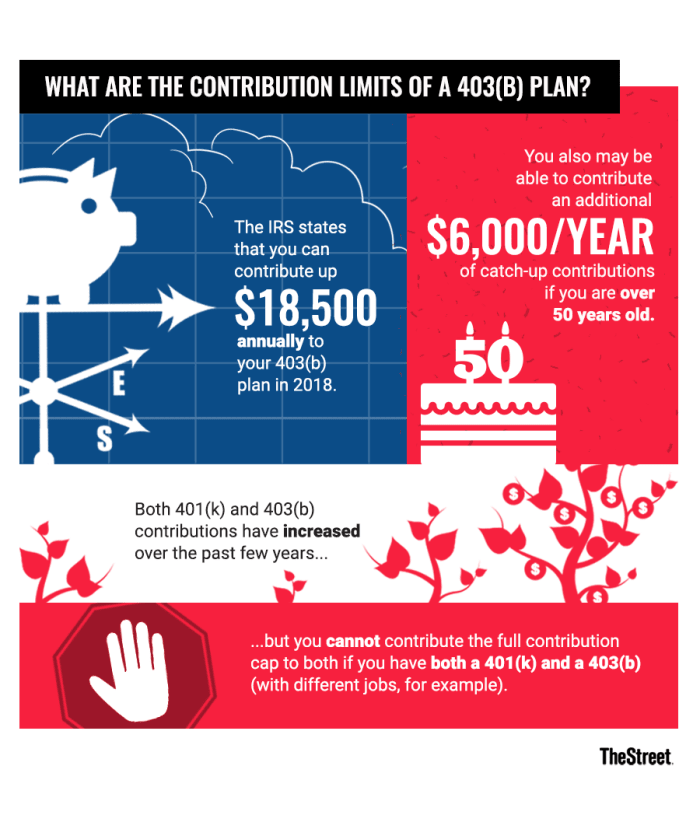

What Is a 403(b) Plan and How Do You Contribute? TheStreet, If you are under age 50, the annual contribution limit is $23,000. For 2025, the total of your elective salary deferral contribution and.

403b Limits 2025 Cami Marnie, The 2025 403 (b) contribution limit is $22,500 for pretax and roth employee contributions. Here are the limits for 2025 and 2025.

Business Concept about 403b Contribution Limits with Sign on the Page, Learn more to secure your future. Contribution limits for 403 (b)s and other retirement plans can change from year to year and are adjusted for inflation.

Retirement Topics 403b Contribution Limits Internal Revenue Service, This limit applies to all employees, regardless. In 2025, the irs has forecasted an increase in the 401 (k) elective deferral limit to $24,000, up by $1,000 from the current limit.

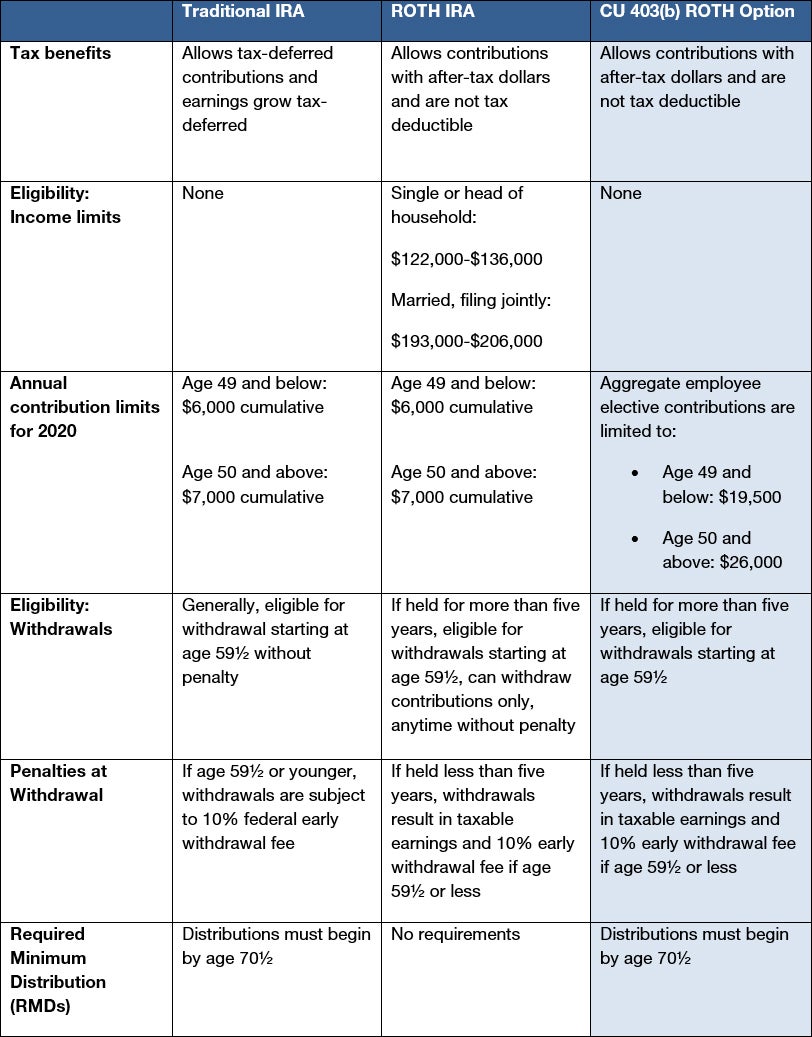

CU’s new 403(b) ROTH option enables aftertax savings for retirement, The 401 (k) contribution limits for 2025 are $23,000 for people under 50, and $30,500 for those 50 and older. The annual 403 (b) contribution limit for 2025 has changed from 2025.

Understanding the 403(b) Retirement Plan The Tech Edvocate, There are actually multiple limits, including an individual. The legislation requires businesses adopting new 401 (k) and 403 (b) plans to automatically enroll eligible employees, starting at a contribution rate of at least 3%,.

Irs 403b Limits 2025 Mara Stacey, Understand the rules and regulations and maximize your savings potential. If you're 50 or older, you can contribute an.

What Is a 403(b) TaxSheltered Annuity Plan?, If you are under age 50, the annual contribution limit is $23,000. On your end, you can.

:max_bytes(150000):strip_icc()/403bplan_final-67070c84b22b42478c5bb4c12792995c.png)

403b And 457 Contribution Limits 2025 Moina Terrijo, Learn more to secure your future. The 2025 403 (b) contribution limit is $22,500 for pretax and roth employee contributions.