2025 Tax Married Jointly Filing Separately. Suppose you’re married filing jointly and you have $260,000 magi, which includes $150,000 in interest, dividends, and capital gains. Although you have $150,000 in net.

The two primary options—married filing jointly and married filing separately—can significantly. The tax is calculated for each spouse or partner separately.

Us Tax Brackets 2025 Married Filing Jointly Vs Separately Angie Bobette, Although you have $150,000 in net.

What Are The Tax Brackets For 2025 And 2025 Married Jointly Lana Carlina, Married couples can decide to file taxes jointly or separately.

2025 Tax Married Jointly Filing Separately Jessi Lucille, When deciding how to file your federal income tax return as a married couple, you have two filing status options:

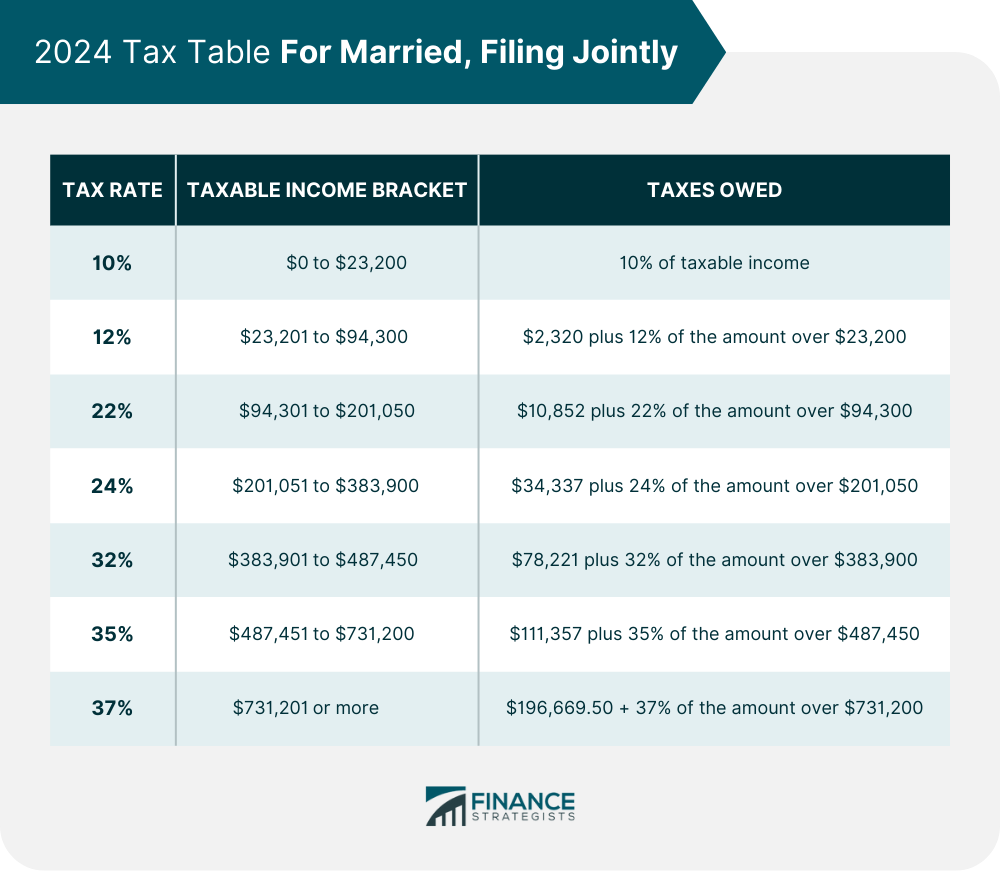

2025 Tax Rates Married Filing Jointly 2025 Mable Rosanne, For the 2025 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately.

2025 Tax Brackets Announced What’s Different?, The standard deduction for married couples filing jointly was $29,200 in 2025, while heads of household saw a $21,900 standard deduction in 2025.

Tax Brackets Definition, Types, How They Work, 2025 Rates, Your bracket depends on your taxable income and filing status.

2025 Tax Brackets Married Filing Separately With Dependents Babb Mariam, You pay tax as a percentage of your income in layers called tax brackets.

2025 Married Filing Jointly Tax Brackets Calculator Coral Dierdre, Married filing separately if you’re married and don’t want to file jointly or find that filing separately lowers your tax.

2025 Tax Brackets Married Filing Separately Excited Emlyn Claudetta, So as long as you got your marriage license in 2025, you were considered.

Tax Brackets 2025 Married Jointly Calculator Elana Harmony, Learn the benefits of each filing status to determine the best option for your return.